What is a Listing Agent?

Generally, a real estate transaction involves a listing agent representing the seller and a buyer’s agent representing the buyer. Listing agents will conduct a Comparative Market Analysis (CMA)—which uses recent housing market data to compare the seller’s home to other listings in their area—to accurately price the property. The agent will list the home, coordinate showings and open houses, and negotiate with buyers’ agents to find the best offer for their client. Once the transaction is complete, the listing agent and buyer’s agent will split the commission of the sale.

Hiring a listing agent removes the risks of selling your own home by placing the selling process in the hands of an experienced licensed professional. Once you’ve found the right agent, you can begin working together to form your selling strategy.

Advantages of Working with a Listing Agent

Accurately Pricing Your Home

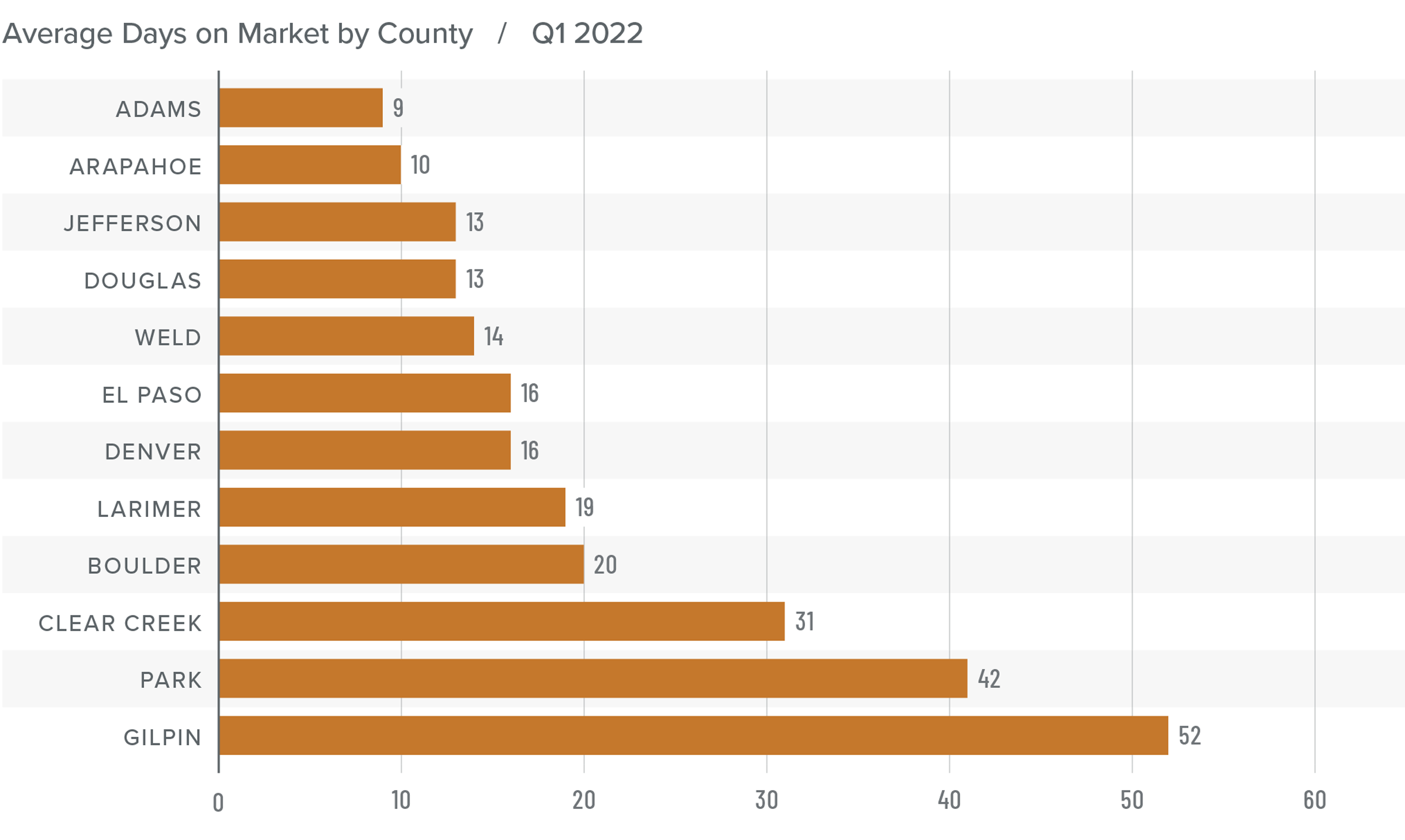

Your listing agent will begin the selling process by finding the value of your home. There are various factors that influence home prices, including seasonality, market conditions, home features, and more. Agents have exclusive access to the data behind these trends, allowing them to conduct a thorough CMA to accurately price your home. Of all the costly mistakes in the selling process, an inaccurately priced home is perhaps the most consequential. An overpriced home will attract the wrong buyers, increase your home’s days on market, and could lead to serious post-sale complications, that, in some cases, could jeopardize the sale. An underpriced home leaves money on the table. With a listing agent’s CMA, you can rest assured that the price of your home is backed by current market data, which will set you and your agent up for successful negotiations.

Marketing Your Home

Listing agents are experienced professionals who possess a wealth of knowledge on how to market your home. Your agent will list your property on the Multiple Listing Service (MLS), an online database to which they have exclusive access. Getting your home listed on the MLS will greatly increase its exposure to interested buyers. Your listing agent will coordinate showings and open houses, opening the door to conversations with buyers and their agents.

Your agent will also make recommendations and help coordinate all marketing efforts, like staging and photography. They’ll also be able to recommend what, if any, repairs need to be made before you go live. Their expertise will streamline the selling process, getting your house ready and on the market quickly.

Offers / Negotiations / Closing

The complexities of the critical stages in the selling process highlight the value of an agent’s expertise. A listing agent will work on your behalf to field and assess incoming offers, communicate with buyers and their agents during negotiations, and ultimately, see the deal through to closing.

Local market conditions can often dictate how your agent approaches offers and negotiations. In a seller’s market, there’s a good chance you will have multiple competing offers on the table, contingencies are often waived, and all-cash offers may arise. Trying to pin down the best offer in these competitive situations can be overwhelming, but listing agents specialize in understanding the terms of these kinds of offers to identify the one that best aligns with your goals. If you’re selling in a buyer’s market, the buyer will have the leverage. Your listing agent will work with the buyer’s agent to reach an agreement on the buyer’s contingencies and finalize the terms of purchase.

From list to closing, your listing agent is there to answer any questions you may have, allay your fears, and guide you toward a successful sale. When searching for an agent, keep in mind that their ability to connect with you on a human level is just as important as their professional qualities. Selling your home can be an emotional roller coaster, and you’ll want someone by your side who you can trust on the journey ahead. If you would like some help connecting with an agent, get started here: https://fosterhomescolorado.com/contact-me

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link